House Rent In Income Tax Declaration . house rent allowance. section 80gg of the income tax act in india allows individuals who pay rent but don't receive house rent allowance. the house rent allowance (hra) is a portion of your salary that is not fully taxable, unlike your basic salary. hra or house rent allowance is a benefit provided by employers to their employees to help the latter cover their. What is the formula to calculate hra? form 10ba is a declaration that has to be filed by an individual who wants to claim a deduction under section 80gg for. Is hra 50% or 40%? what is hra? Salaried people residing in rental housing are eligible to claim the hra tax exemption. What is the hra limit for 2024? Hra exemption is calculated based on multiple things like the actual rent paid, the base pay or salary of the individual, and the location of the rental housing.

from wbpay.in

house rent allowance. Is hra 50% or 40%? What is the formula to calculate hra? Salaried people residing in rental housing are eligible to claim the hra tax exemption. What is the hra limit for 2024? Hra exemption is calculated based on multiple things like the actual rent paid, the base pay or salary of the individual, and the location of the rental housing. the house rent allowance (hra) is a portion of your salary that is not fully taxable, unlike your basic salary. what is hra? section 80gg of the income tax act in india allows individuals who pay rent but don't receive house rent allowance. hra or house rent allowance is a benefit provided by employers to their employees to help the latter cover their.

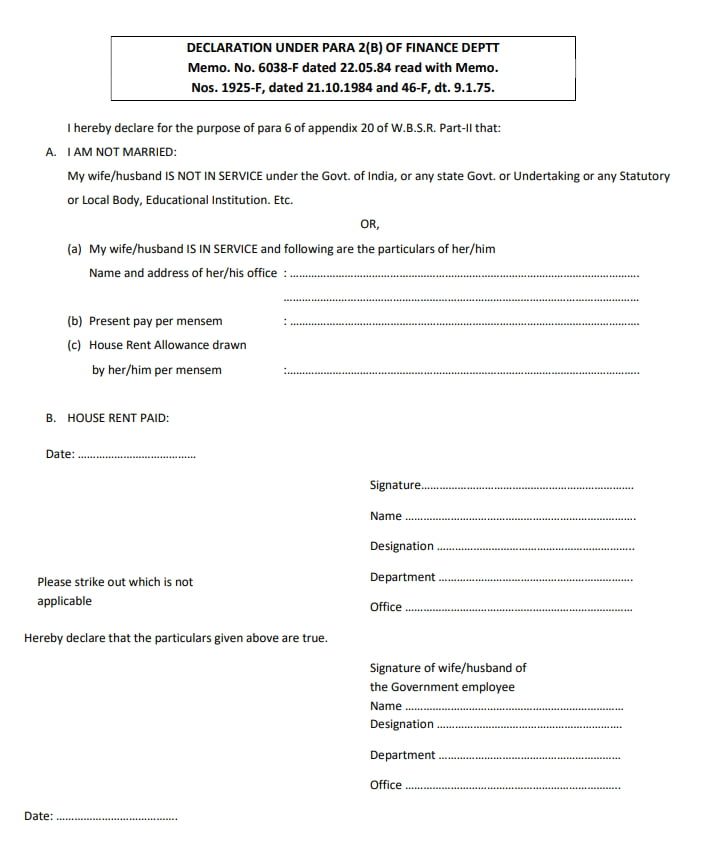

House Rent Declaration Rule and Form WBPAY.in

House Rent In Income Tax Declaration What is the formula to calculate hra? what is hra? Is hra 50% or 40%? Salaried people residing in rental housing are eligible to claim the hra tax exemption. What is the formula to calculate hra? hra or house rent allowance is a benefit provided by employers to their employees to help the latter cover their. the house rent allowance (hra) is a portion of your salary that is not fully taxable, unlike your basic salary. What is the hra limit for 2024? house rent allowance. Hra exemption is calculated based on multiple things like the actual rent paid, the base pay or salary of the individual, and the location of the rental housing. form 10ba is a declaration that has to be filed by an individual who wants to claim a deduction under section 80gg for. section 80gg of the income tax act in india allows individuals who pay rent but don't receive house rent allowance.

From www.formsbirds.com

Rental Sample Form Free Download House Rent In Income Tax Declaration What is the formula to calculate hra? the house rent allowance (hra) is a portion of your salary that is not fully taxable, unlike your basic salary. section 80gg of the income tax act in india allows individuals who pay rent but don't receive house rent allowance. form 10ba is a declaration that has to be filed. House Rent In Income Tax Declaration.

From tax2win.in

Rent Receipts Generator Generate Free Rent Receipts Online Tax2win House Rent In Income Tax Declaration Hra exemption is calculated based on multiple things like the actual rent paid, the base pay or salary of the individual, and the location of the rental housing. house rent allowance. section 80gg of the income tax act in india allows individuals who pay rent but don't receive house rent allowance. What is the hra limit for 2024?. House Rent In Income Tax Declaration.

From www.doorloop.com

How Rental Tax Works (+ Tips for Reducing Tax Burden) House Rent In Income Tax Declaration What is the hra limit for 2024? What is the formula to calculate hra? house rent allowance. Hra exemption is calculated based on multiple things like the actual rent paid, the base pay or salary of the individual, and the location of the rental housing. the house rent allowance (hra) is a portion of your salary that is. House Rent In Income Tax Declaration.

From ck5354.blogspot.com

Tax on Rental oh Tax on Rental KLSE malaysia House Rent In Income Tax Declaration the house rent allowance (hra) is a portion of your salary that is not fully taxable, unlike your basic salary. form 10ba is a declaration that has to be filed by an individual who wants to claim a deduction under section 80gg for. Hra exemption is calculated based on multiple things like the actual rent paid, the base. House Rent In Income Tax Declaration.

From wbpay.in

House Rent Declaration Rule and Form WBPAY.in House Rent In Income Tax Declaration house rent allowance. Salaried people residing in rental housing are eligible to claim the hra tax exemption. Hra exemption is calculated based on multiple things like the actual rent paid, the base pay or salary of the individual, and the location of the rental housing. What is the hra limit for 2024? form 10ba is a declaration that. House Rent In Income Tax Declaration.

From www.homebazaar.com

Rent Receipt And Its Role In Claiming Tax Benefits House Rent In Income Tax Declaration Is hra 50% or 40%? house rent allowance. What is the formula to calculate hra? hra or house rent allowance is a benefit provided by employers to their employees to help the latter cover their. form 10ba is a declaration that has to be filed by an individual who wants to claim a deduction under section 80gg. House Rent In Income Tax Declaration.

From www.templateroller.com

Form RC519 Download Fillable PDF or Fill Online Declaration of Tax House Rent In Income Tax Declaration What is the hra limit for 2024? Is hra 50% or 40%? what is hra? Salaried people residing in rental housing are eligible to claim the hra tax exemption. section 80gg of the income tax act in india allows individuals who pay rent but don't receive house rent allowance. house rent allowance. the house rent allowance. House Rent In Income Tax Declaration.

From rentalagreement.in

Rent Receipt Formats Declaration Form RentalAgreement.in House Rent In Income Tax Declaration Hra exemption is calculated based on multiple things like the actual rent paid, the base pay or salary of the individual, and the location of the rental housing. the house rent allowance (hra) is a portion of your salary that is not fully taxable, unlike your basic salary. Salaried people residing in rental housing are eligible to claim the. House Rent In Income Tax Declaration.

From teacherharyana.blogspot.in

House Rent Allowance (HRA) receipt Format for tax TEACHER HARYANA House Rent In Income Tax Declaration What is the hra limit for 2024? Salaried people residing in rental housing are eligible to claim the hra tax exemption. section 80gg of the income tax act in india allows individuals who pay rent but don't receive house rent allowance. house rent allowance. Is hra 50% or 40%? what is hra? the house rent allowance. House Rent In Income Tax Declaration.

From classlesdemocracy.blogspot.com

Rent Receipt Template For Tax Classles Democracy House Rent In Income Tax Declaration What is the formula to calculate hra? what is hra? house rent allowance. section 80gg of the income tax act in india allows individuals who pay rent but don't receive house rent allowance. hra or house rent allowance is a benefit provided by employers to their employees to help the latter cover their. Is hra 50%. House Rent In Income Tax Declaration.

From www.slideshare.net

House rent receipt House Rent In Income Tax Declaration section 80gg of the income tax act in india allows individuals who pay rent but don't receive house rent allowance. hra or house rent allowance is a benefit provided by employers to their employees to help the latter cover their. What is the hra limit for 2024? house rent allowance. Hra exemption is calculated based on multiple. House Rent In Income Tax Declaration.

From speedhome.com

How To Declare Your Rental for LHDN 2021 SPEEDHOME Guide House Rent In Income Tax Declaration What is the hra limit for 2024? hra or house rent allowance is a benefit provided by employers to their employees to help the latter cover their. form 10ba is a declaration that has to be filed by an individual who wants to claim a deduction under section 80gg for. What is the formula to calculate hra? Is. House Rent In Income Tax Declaration.

From exorxgvpx.blob.core.windows.net

House Rent Deduction For Tax at Jackie Grisby blog House Rent In Income Tax Declaration form 10ba is a declaration that has to be filed by an individual who wants to claim a deduction under section 80gg for. the house rent allowance (hra) is a portion of your salary that is not fully taxable, unlike your basic salary. Hra exemption is calculated based on multiple things like the actual rent paid, the base. House Rent In Income Tax Declaration.

From audiodsae.weebly.com

House rent receipt for tax exemption audiodsae House Rent In Income Tax Declaration section 80gg of the income tax act in india allows individuals who pay rent but don't receive house rent allowance. What is the formula to calculate hra? Is hra 50% or 40%? What is the hra limit for 2024? Hra exemption is calculated based on multiple things like the actual rent paid, the base pay or salary of the. House Rent In Income Tax Declaration.

From www.kalviexpress.in

RECEIPT OF HOUSE RENT Under Section 1 (13 A) of Tax Act House Rent In Income Tax Declaration house rent allowance. form 10ba is a declaration that has to be filed by an individual who wants to claim a deduction under section 80gg for. Hra exemption is calculated based on multiple things like the actual rent paid, the base pay or salary of the individual, and the location of the rental housing. Salaried people residing in. House Rent In Income Tax Declaration.

From vakilsearch.com

Rent Receipt Format A Complete Guideline House Rent In Income Tax Declaration Is hra 50% or 40%? hra or house rent allowance is a benefit provided by employers to their employees to help the latter cover their. section 80gg of the income tax act in india allows individuals who pay rent but don't receive house rent allowance. Salaried people residing in rental housing are eligible to claim the hra tax. House Rent In Income Tax Declaration.

From incometaxformsgorokura.blogspot.com

Tax Forms Rental Tax Forms House Rent In Income Tax Declaration What is the formula to calculate hra? What is the hra limit for 2024? Salaried people residing in rental housing are eligible to claim the hra tax exemption. house rent allowance. hra or house rent allowance is a benefit provided by employers to their employees to help the latter cover their. Is hra 50% or 40%? what. House Rent In Income Tax Declaration.

From www.makaan.com

Rent Receipt Format, Uses, Mandatory Revenue Stamp Clause House Rent In Income Tax Declaration form 10ba is a declaration that has to be filed by an individual who wants to claim a deduction under section 80gg for. Salaried people residing in rental housing are eligible to claim the hra tax exemption. hra or house rent allowance is a benefit provided by employers to their employees to help the latter cover their. Is. House Rent In Income Tax Declaration.